If there are financials or support obligations associated with your case, you will need to file financial information with the court before a temporary orders hearing.

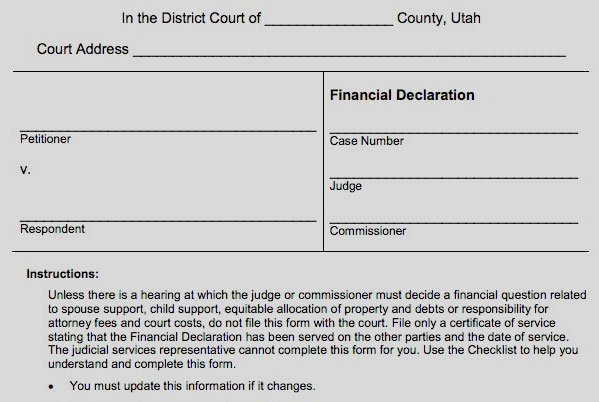

The Utah Rules of Civil Procedure list requirements and deadlines for the exchanging of financial information in the form of Financial Declarations. These are included in rules 26 and 26.1 for domestic cases.

The requirements outlined in these rules, and in the Financial Declaration form provided by the court, can be rather lengthy as parties must gather and exchange years of pay stubs, tax returns, bank statements, and proof of expenses.

Recently the Utah Bar held a lunch course for attorneys with Commissioners Joanna Sagers and Kim Luhn, from the Third District Court. The Commissioners outlined some common mistakes and helpful tips when it comes to filling out a Financial Declaration and submitting that information to the Commissioners for a temporary orders hearing. Below is a condensed version of some of the topics covered by the Commissioners.

Must file a Financial Declaration for a hearing before a Commissioner

Filling out a Financial Declaration can be overwhelming, especially if there are multiple bank accounts, various retirement accounts, credit card debt and numerous other assets and debts to list. However, it is nearly impossible for the Commissioners to accurately calculate temporary support awards, or recommend the payment of bills and debts on a temporary basis without the actual information in front of them. If you fail to file a Financial Declaration before a temporary orders hearing you may jeopardize the outcome, including not being awarded the support you need, or being ordered to pay an amount you cannot afford.

Include a detailed list of monthly expenses

There is a monthly expenses chart at the end of the Financial Declaration for you to list your actual monthly expenses. If you guess or use round numbers it is more likely the Commissioner will question whether an expense is excessive or reasonable. When filling out the expenses chart, put the true monthly amounts.

For example, with your monthly electricity bill do not enter $100.00, rather enter $97.00 as the amount you last paid or an average for the year. Also, if your property insurance and property taxes are included with your monthly mortgage payment, make a note of that on the Financial Declaration, do not enter these amounts twice as if they are paid separately. Also, consider whether you and the other party have listed duplicate expenses, for example does the other party pay the health insurance premiums, and if so, you should indicate these amounts are currently being paid by the other party.

Do not speculate on what your expenses will be eventually

The Commissioners are making the recommendation for temporary orders on just that basis – a temporary one, as in what is the current situation. For example, if you are not currently in school or paying for school loans, do not list that on your expenses. If you are living with a relative, but would like to get your own apartment, then find out what your actual monthly rent may be if you moved. The Commissioner’s prefer more detail as opposed to entering a monthly rent amount of $1,000.00 and stating “I want to move out.” Find an apartment, get a copy of the lease and a statement as to what the monthly rent will actually be, even if you have not moved yet this is the information the Commissioners need.

Know the number of paychecks you receive in a year

Most people are paid routinely either twice a month or every other week. If you are paid twice a month you receive 24 paychecks in a year (12 months x 2 paychecks = 24). If you are paid every other week you receive 26 paychecks per year (52 weeks per year / every other week = 26). Why does this make a difference? Well here is an example:

Say you are paid a salary of $50,000.00 a year and are paid twice a month, then $50,000.00 divided by 24 paychecks is $2,083.00 per paycheck. If you are paid every other week, then $50,000.00 divided by 26 paychecks is $1,923.00. That is a paycheck difference of $160.00.

This may or may not come in to play at a temporary orders hearing, but it is good for you to know as you are navigating the division of financials and the calculation of monthly support awards.

Financial documentation that should be filed with the court

The Financial Declaration requires parties exchange various statements and proof of the assets, debts, and expenses that are listed. You may not need to file all of these statements and receipts with the court. You should consider filing tax returns and paystubs with the court, and also proof of any amounts that may be disputed by the other party. If you are unsure, you should try calling the Commissioner’s court clerk and asking what financial documentation the Commissioner likes to review with the Financial Declarations.

Calculating alimony on a temporary basis

The Commissioners may award a temporary alimony amount at a temporary orders hearing based upon the financial information provided by the parties. This usually includes determining the parties’ monthly income, the amount of reasonable monthly expenses for both parties, the ability of the parties to provide for themselves, the financial needs of each party, and the ability of either party to provide support to the other’s financial needs.

The Commissioners have indicated in calculating temporary alimony, especially if there is not enough money to go around, some expenses that may be questioned or reduced include contributions to retirement accounts, donations, gifts, and contributions to adult children.

Summarize information

If there are a great number of detailed financials you would like the Commissioner to know and consider, consider creating a summary of these amounts for the Commissioner to review in a chart or separate document. This may also be helpful during the litigation process as you and the other party are trying to explain and divide financials.

Determine what expenses are agreeable between the parties

If you and the other party agree on the amounts of certain expenses, let the Commissioner know you agree and are not disputing these expenses. This way the hearing will be more focused and narrowly tailored for everyone’s time.

The Commissioners do their best to read the pleadings that have been submitted before a hearing to prepare, especially when reviewing the financial situation of the parties. You are far more likely to receive a workable temporary solution if you provide the Commissioners with accurate and detailed information.